In-Depth Report on AI + Crypto Payments: Building the Value Transfer Engine for the Age of Intelligent Finance

HTX learnLearned by 105 usersPublished on 2025.07.17 Last updated on 2025.07.17

1 lessons in total

- 01In-Depth Report on AI + Crypto Payments: Building the Value Transfer Engine for the Age of Intelligent FinanceLatest

I. Introduction: From Payment Tools to Intelligent Collaboration Hubs

As the two technological waves of Web3 and artificial intelligence (AI) converge, crypto payments are being redefined. Once primarily serving the underlying function of value transfer, crypto payments are now evolving into the execution hub of the "AI economy", connecting intelligent collaboration networks across data, computing power, users, and assets.

The core logic behind this trend is that AI endows payment systems with dynamic decision-making capabilities, while blockchain provides a trusted execution environment. Together, they create a closed loop of "on-chain data – intelligent processing – automated payment". This not only reshapes the efficiency and structure of payment systems but also unlocks new possibilities for the innovation of business models, the redesign of user incentive systems, and the off-chain digital transformation.

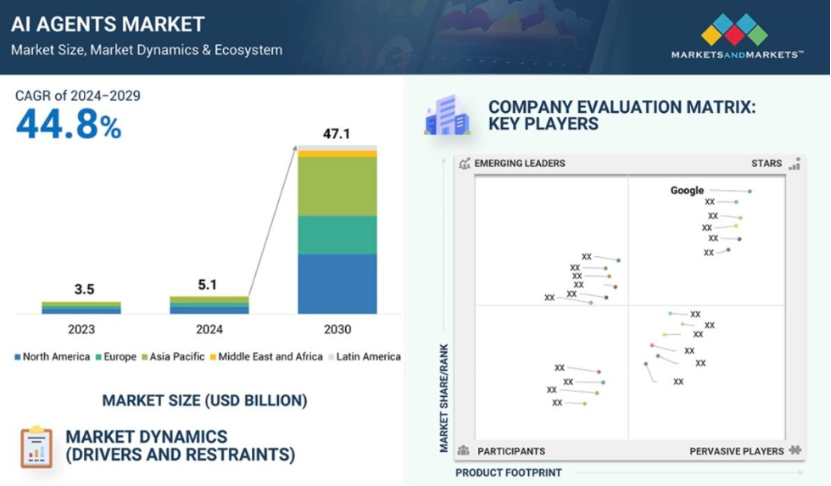

As projected by MarketsandMarkets, the AI agent market will reach $47.1 billion by 2030, with crypto payments emerging as the infrastructure and economic lifeblood of this new ecosystem.

II. The Integration Mechanism: Why AI + Crypto Payments Make Sense?

The deep integration of AI and crypto payments is becoming a widely accepted paradigm shift not merely because both technologies are at the forefront of the technology cycle, but more importantly, because they are highly aligned in operational logic, execution methods, and value structures. In traditional financial systems, payment is the endpoint of a centralized clearing system and is essentially a quasi-administrative action revolving around "account control", leaving no room for intelligent agents to operate within the system. In contrast, in the AI context, especially within agent systems powered by large models, the operational model naturally demands an open, automated, and minimally dependent payment interface, making crypto payment systems the optimal solution to address this need.

At the foundational level, AI's key capabilities lie in processing inputs logically, predicting behaviors, and executing strategies. Payment is the direct channel through which strategies can be implemented. If an Agent cannot access a payment channel, its autonomy halts at the inference stage. Similarly, if the payment system cannot respond to the Agent's data feedback, it loses the ability to dynamically optimize its execution path. Compared to traditional payment systems, plagued by multiple permissions, delayed processing, and account restrictions, crypto payments are natively programmable and permissionless. They allow AI to directly generate and operate wallets, sign transactions, call contracts, set limits, and even carry out cross-chain settlements, all executed transparently on-chain without the need for human intervention. The collaboration at this mechanism layer marks the first time the principle of "machines as users" truly materializes at the payment execution layer.

Furthermore, on-chain payments are not only the completion of an action but also the output of data. Every transaction is recorded in a verifiable state database, becoming a critical input for AI models to optimize their future behaviors. AI can continuously iterate user profiles based on dimensions such as transaction frequency, timing, amounts, and asset types, enabling personalized incentives, risk assessments, and interaction strategies. For instance, in the case of Boba Guys, the AI-driven Crossmint system automatically reconstructed processes such as loyalty points accrual, discount distribution, and payment recommendations by identifying user behavior pathways, making "payment" no longer a closed outcome but an open, cyclical relay point. In this model, payment is data, feedback, and intelligent incentives.

Even more noteworthy is the qualitative shift in incentive systems brought about by the combination of AI and crypto payments. Typically based on fixed rules, uniform parameters, and static judgments, traditional incentive systems struggle to adapt to complex user behavior patterns. The introduction of AI endows incentive mechanisms with dynamic adaptability, such as changing point redemption rates based on user activity, automatically detecting potential user loss and issuing retention rewards based on session duration, and even offering differentiated pricing services according to users' contribution levels. All these incentive actions can be executed automatically via smart contracts in combination with the native divisibility and composability of cryptocurrencies, thereby significantly reducing operational costs while enhancing interaction efficiency.

From a system architecture perspective, the integration of AI and crypto payments brings unprecedented composability and explainability. Traditional payment systems function as closed black-box structures, making it difficult for external intelligent systems to access or audit their operations. In contrast, the verifiability and modular interfaces of on-chain payments turn them into embeddable, callable, and traceable behavioral engines for AI agent systems. New payment protocols represented by AEON even allow AI Agents to automatically switch payment routes based on task requirements, network conditions, and fee strategies, autonomously handling cross-chain asset calls and transaction confirmations. In this mechanism, payment is no longer the outcome of a single path, but a node within an ongoing process of agent collaboration and strategic execution. This serves as a critical foundation for building the next-level "machine economy".

Overall, the fusion of AI and crypto payments is not merely a technical patchwork but rather an endogenous unification of operational logic. AI systems need open, real-time, feedback-capable payment infrastructure to achieve autonomous decision-making, while crypto payment systems require agents' continuous calls and learning capabilities to evolve from transactions to growth. The synergy between the two is giving rise to an entirely new kind of "intelligent execution economy", where payment is no longer a singular action but a closed-loop system of dynamic responses, continuous evolution, and coordinated incentives. In the future, any Web3 application, AI platform, retail setting, or even social network could be embedded with this intelligent payment hub, making automated actions financially logical and enabling value transfers to be cognitively informed. This is precisely the deep foundation of "AI + crypto payments" and also the key pillar supporting its realization as a new paradigm.

III. Key Project Case Studies: Real-World Implementation Pathways for AI + Crypto Payments

1. Crossmint + Boba Guys: A Retail Paradigm Shift from Payment Tool to Closed-Loop User Incentive System

Amid the wave of integration between Web3 and traditional retail, Crossmint's payment infrastructure has provided numerous non-crypto-native enterprises with usable, deployable on-chain payment gateways. Its collaboration with U.S. bubble tea brand Boba Guys serves as a standout example. Boba Guys faced a major challenge: traditional payment data failed to effectively activate its loyalty program and lacked personalized recommendations and dynamic incentives, resulting in severe user loss and low repurchase rates. Crossmint built a Solana-based on-chain payment and AI membership system for the company. When a user places an order, a non-custodial wallet is created, and the transaction is transparently recorded on-chain, without the need for the user to understand gas fees or crypto wallets. All consumption data is uploaded in real time, and the AI system then profiles each user and delivers personalized discounts and points redemption strategies.

In this process, AI is more than just a recommendation tool; it serves as the intermediary between marketing and payment, automatically determining who deserves to be incentivized, in what form, and when, based on an AI analysis of consumption preferences and past behaviors. The loyalty program is no longer a static point scheme but has become a dynamic, self-evolving intelligent system. Within three months of launch, the program attracted over 15,000 registered members, increased in-store visits by loyalty members by 244%, and boosted average consumption per member to more than 3.5 times that of non-members. This model, for the first time, verifies the actual conversion capability of AI + crypto payments in everyday consumption scenarios and establishes a replicable paradigm for high-frequency consumption sectors such as convenience stores, gyms, and coffee chains: payment is interaction, behavior is incentive, and what is on-chain is trustworthy.

2. AEON: Building a Native Crypto Payment Execution Protocol for AI Agents

AEON is a lower-level crypto payment protocol designed for developers and technical platforms. What sets it apart is that it is purposely built for AI agents, aiming to equip agents with real, verifiable value execution capabilities. Unlike Web2 payment systems that rely on centralized accounts, payment gateways, and permission verification, AEON's design philosophy is to enable every agent to independently manage its own payment permissions, intelligently call on-chain assets, and freely switch between optimal payment routes across multiple chains. Users can issue commands in natural language to an AI, such as "book a ticket" or "call a cab", and the agent translates the task semantics into payment intent. Then, AEON automatically handles payment creation, asset determination, cross-chain routing, and transaction broadcasting. The entire process is free of user intervention.

AEON has developed an intelligent pathway that combines payment intent recognition with multi-chain payment execution, allowing AI to make autonomous strategic decisions based on real-time data while also taking on the role of the payment principal. In addition, its Agent-to-Agent collaboration framework allows one AI agent to act as the information producer and another as the payment executor, thereby forming a truly decentralized and automated task chain. For example, a recommendation agent might search for hotels while another payment agent handles settlement, with AEON serving as the payment bridge between the two, realizing a working prototype of the machine-to-machine collaboration economy. At present, AEON is already live in various QR code payment scenarios in Vietnam, spanning e-commerce, local services, offline transactions, and more, paving the way for broader crypto payment adoption in Southeast Asia. The protocol currently supports mainstream networks such as BNB Chain, Solana, TON, TRON, and Stellar, showcasing remarkable capabilities for cross-ecosystem expansion.

The significance of AEON lies not just in payment execution itself but in the fact that it has proposed a composable, verifiable, and embeddable payment standard for intelligent agents, thus transforming payments from human-triggered actions into execution logic completed autonomously by agents. This architecture could become the universal middleware standard for the future AI agent economy, propelling Web3 applications toward truly autonomous execution.

3. Gaia Network + MoonPay: Driving Seamless Integration of Fiat On-Ramps and AI Agent Networks

Gaia Network is a decentralized platform specifically built for deploying AI agents, designed to help developers create tradable AI agents that run continuously. Meanwhile, MoonPay is a world-leading crypto payment gateway offering instant fiat-to-crypto exchange services. Their partnership is significant in that it establishes, for the first time, a complete pathway of "Web2 fiat currencies → AI calls → Web3 assets".In Gaia, users can issue requests to agents via voice or text (such as "buy $100 worth of ETH"), and the AI will call the MoonPay API to carry out the entire process of pricing, payment, on-chain execution, and transfer. Users don't need to understand wallets, gas fees, or on-chain operations, as the entire process is automatically completed by AI, with transaction records made publicly accessible and fully transparent.

MoonPay's role is to lower the barriers to entry for crypto payments. With its embedded payment window and low-code modules, Gaia developers can integrate on-chain payment features into their agents in just a few minutes. At the same time, MoonPay supports multi-chain asset swaps, allowing Gaia agents to execute high-frequency trades across chains like Polygon and Solana and operate in complex scenarios such as micro-incentives and AI service subscriptions. As Gaia rolls out in multiple countries worldwide, MoonPay's compliance advantage makes it a trusted value conduit. In 2024, the platform became one of the first crypto payment companies to obtain regulatory approval under the EU's MiCA framework, with its monthly active users surpassing 50,000. This marks that the adoption of AI + payments is accelerating toward globalization and compliance.

The strategic significance of this partnership is twofold. On the one hand, it enhances user-friendliness by solving the "wallet barrier" problem. On the other hand, it provides AI agents with the payment middleware and settlement mechanism necessary for commercialization, elevating Web3 agents from "information tools" to "transaction executors". In addition to bridging the gaps between Web2 and Web3, fiat and crypto, and AI and payments, it also offers a practical blueprint and pathway for the global adoption of the intelligent agent economy.

IV. Challenges and Trends: A Roadmap Toward the "Intelligent Payment Economy"

Although "AI + crypto payments" shows strong potential for systemic synergy and real-world commercialization, its adoption still faces a series of key challenges. These include not only technical complexity and interoperability issues, but also multi-dimensional barriers related to compliance, security, and user awareness. Only by identifying and actively addressing these structural hurdles can we lay a solid foundation for truly entering the era of the "intelligent payment economy" in the future.

First and foremost, technical complexity remains the most formidable challenge. AI and blockchain represent two of the most sophisticated technological systems today. Their integration is not simply a matter of "layering" one on top of the other; it involves deep coupling. This requires payment protocols to meet AI's demands for high-frequency, low-latency performance, while also ensuring the transparency and security needed for on-chain asset calls. On the one hand, multi-chain compatibility is becoming a standard requirement. Payment systems must dynamically route based on factors like transaction speed, gas costs, and contract stability. Yet the security and real-time performance of cross-chain bridges still fall short of expectations. On the other hand, AI agents need sufficient autonomy and control interfaces to initiate payments in a secure and verifiable manner, but how to build such a "trusted AI authorization model" is still in the early experimental stage.

Second, compliance pressure is a major constraint on global expansion. As AI agents gain greater autonomy in initiating payments, regulators are paying growing attention to compliance concerns such as payment initiation rights, user fund control, and anti-money laundering (AML) reviews. Europe's MiCA, the U.S.'s SEC and FinCEN, and China's multi-layered regulations on cross-border data flows and AML could all be roadblocks to platform expansion. In particular, once AI is granted authority over fund allocation and payment execution, we will face key questions such as who is legally responsible and whether this constitutes "shadow banking" or "illegal payment agency". These issues urgently call for legislative clarification. While platforms like MoonPay have obtained compliance licenses in some regions, their business expansion remains geographically constrained, and many developers struggle to implement unified technical architectures across different markets.

Second, educating users and raising awareness remains costly and has become a major bottleneck to large-scale adoption. Although AI agents + crypto payments offer a seamless technical experience, hurdles still exist in areas like on-chain wallets, gas fees, and authorization mechanisms. This is especially true for non-crypto-native users, many of whom lack a basic understanding of concepts such as "wallets are accounts" and "automatic spending via smart contracts". When something goes wrong (such as erroneous AI payments and asset loss), there are still no mature mechanisms in place for assigning liability, recovering assets, or compensating users. This may easily erode user trust. This issue is particularly acute in retail, e-commerce, and financial service scenarios. For platforms to truly break into the mainstream market, it is essential to design the user experience to be completely seamless and invisible from the ground up.

Despite these daunting challenges, the vision of an "intelligent payment economy" represented by AI + crypto payments is steadily taking shape, revealing distinct development trajectories and transformational trends.

First, there is an accelerated trend toward lightweight, scenario-specific adoption. The future battlefield for AI + crypto payments may not lie in large-scale asset settlements but rather in small-amount, high-frequency segments, such as in-game prop purchases, retail membership discounts, tipping for creators, AI service subscriptions, and other microtransaction use cases. In these contexts, AI excels at adapting strategies and interpreting user intent, while crypto payments' borderless nature helps overcome the fragmentation inherent in traditional payment systems. The rapid success of the Boba Guys model means that spaces like convenience stores, gyms, and sharing economy platforms could all become testing grounds for the latest technologies, bringing crypto payments from on-chain into everyday life.

Second, the underlying infrastructure tends to be more modular and standardized. Currently, AI payment projects operate mostly as standalone systems with custom APIs, which raises development barriers and lowers reusability, ultimately slowing ecosystem expansion. In the coming years, projects like MoonPay, Crossmint, and AEON are expected to drive the development of unified SDKs, standardized payment interfaces, and identity/wallet abstraction protocols so that developers can integrate intelligent payment capabilities as easily as using Stripe or Firebase. This development will tremendously improve cross-platform interoperability and help establish a general-purpose tech stack connecting payments, agents, data, and identity.

Third, AI will evolve from a mere payment executor into an active architect of compliance frameworks. As regulatory pressure intensifies and technical capabilities advance, AI will increasingly take on the role of "compliance intelligence". For example, it will be expected to automatically identify illegal commands, detect money laundering pathways, flag blacklisted addresses, and generate smart tax reports. In this future, payment processes will not only facilitate value transfers but will also integrate functions such as compliance, risk control, and identity verification, becoming part of a multi-layered "trusted payment infrastructure". This may ease regulators' concerns over the risk of "rogue AI agents" and pave the way for intelligent payments to be incorporated into compliance frameworks.

Ultimately, the roadmap toward the "intelligent payment economy" is not a linear path forward but rather a "multi-dimensional network that unfolds layer by layer": beginning with small-scale use cases, converging around ecosystem standards, and gradually integrating into regulatory systems. This evolution must be driven by user experience, supported by developer tooling, and centered around technological synergy. Only in this way can the integration of AI and crypto payments move beyond a lab-born fantasy and become a vital engine driving the adoption of the Internet of Value.

V. Conclusion: Reconstructing Payment Sovereignty in the Era of Intelligent Agents

AI is rapidly becoming the most powerful interface for the collaboration between humans and systems, while crypto payments act as the backbone for value transmission and responsibility enforcement within this collaboration. When these two converge, an unprecedented digital economic paradigm is taking shape, where payments are no longer static actions but dynamic, intelligent behaviors, no longer initiated directly by humans but automatically executed by trusted agents that understand context and intent. From AI generating payment intent by AI, calling on-chain assets, selecting optimal execution paths, and performing cross-chain settlements to delivering feedback on behavioral outcomes, this closed loop signifies a fundamental shift in the payment paradigm: from manual user operations to trusted machine agents, and from platforms monopolizing execution rights to users owning sovereignty over agent systems.

Amid this trend, traditional payment systems are built on top of centralized identity, account systems, and settlement networks, where users' payment permissions are essentially usage rights granted by the platform rather than sovereignty. You can use an account, but you cannot define the account rules; you can initiate a transaction, but the payment routing, priority, and fee structures are entirely controlled by banks or platforms. The rise of AI + crypto payment systems is breaking through these limitations: users can entrust agents to manage assets and initiate transactions on their behalf, with every call being verifiable, traceable, and revocable on the blockchain, truly shifting payment sovereignty from platforms back to users.

This reconstruction of payment sovereignty will not happen overnight. It requires support from a range of infrastructures and conceptual frameworks, including account abstraction, compliant programmability, AI permission systems, automated wallets, micropayment networks, and cross-chain settlement protocols. From Crossmint to AEON, from Gaia to MoonPay, from Boba Guys' AI-driven loyalty programs to language agents that automatically pay for air tickets, these are not isolated innovations but interconnected nodes that form the early architecture of a new financial system. They all point to a longer-term vision: in the near future, payment will no longer be just an action but a right, no longer a feature provided by platforms but a protocol-level consensus.

Just as data sovereignty marked a moment of awakening for Web2 users, "payment sovereignty" may be the starting point for Web3's true integration into the fabric of society and everyday economic life. In this new order, users own agents, agents hold logic, logic follows code, code is written on-chain, and on-chain execution feeds value back to users. Payment is no longer merely about "settling the bill"; it has become the core interface connecting user intent, intelligent responsiveness, and economic incentives.

This is a profound structural paradigm shift, which liberates users' rights to use, redefines the boundaries of platforms, reshapes the logic of asset flow, and redistributes trust across commercial relationships. AI gives payment the ability to "think", while crypto gives it "freedom". Together, they not only reshape modern financial technology but also return payment sovereignty to its rightful owners.

In this era of intelligent agents, whoever holds the power to define payment holds the key to the next-generation digital economy.

PreviousNextMore Tutorials

Share to

Language