HTX Ventures 2023 Year-In-Review

HTX Ventures Learned by 644 usersPublished on 2023.12.18 Last updated on 2024.02.18

Blockchain

1 lessons in total

- 01HTX Ventures 2023 Year-In-ReviewNot Started

Our Journey:

2023 marks a transformative era for the company, as we rebrand from the well-known 'Huobi' to 'HTX', celebrating our 10th Anniversary. Our evolution from Huobi to HTX signifies more than a name change; it's a recommitment to our core values - 'H' for our Huobi heritage, 'T' for our dedication to TRON, and 'X' for the dynamic nature of our exchange. For HTX Ventures, 2023 also marked several structural enhancements, including the integration of the incubation and research departments, to further refine resource allocation and strengthen support systems for our investment and ecosystem partners.

HTX Ventures started its journey in 2018 and is dedicated to empowering a wide array of projects that leverage the cutting-edge potential of Web 3.0 and crypto technologies. Our focus spans a diverse range of sectors including DeFi, Real World Assets (RWAs), ZK roll-ups, Infrastructure, NFTs, Digital Identity (DID), SocialFi, Education, GameFi, AI, Layer 1 and Layer 2 projects. This diverse investment approach reflects our commitment to staying at the forefront of technological advancement and innovation.

At the core of HTX Ventures' philosophy lie three pivotal pillars: business innovation, robust business models, and operational excellence. These guiding principles are crucial in shaping our investment strategy, ensuring that we not only support ventures at the vanguard of technological innovation but also those demonstrating sustainable and scalable business models. It is this combination of foresight in technology and acumen in business strategy that enables us to identify and nurture ventures with the potential for lasting impact and growth.

Our comprehensive investment strategy, which incorporates both direct and fund investing, has led to a significant expansion of our portfolio, now encompassing over 200 ventures. This approach has not only diversified our investment landscape but also enriched our capacity to drive meaningful change across various sectors. Each investment is a testament to our unwavering commitment to fostering innovation, sustainability, and excellence in the dynamic world of Web 3.0 and beyond.

2023 Market Overview and Market Outlook

As we reflect on the year 2023, the landscape of the cryptocurrency and blockchain sectors has unfolded a tapestry of significant developments, challenges, and innovations.

Infrastructure

The year 2023 has been a breakthrough year for infrastructure in the blockchain space. Observing the entire infrastructure ecosystem, we see a multitude of solutions and technological approaches emerging to cater to the ever-increasing variety of Web3 use cases and users. These solutions and approaches, intertwining and overlapping, await market validation. Regardless, they consistently revolve around three key focuses: faster transaction speeds, more decentralized structures, and more secure architectures. The ultimate goal is to create a more user-friendly blockchain network. There's much to discuss regarding infrastructure, and here we select a few noteworthy topics from 2023 for review.

Five Notable Infrastructure Topics of 2023

1. Ethereum’s Development Roadmap:

As the most expansive public blockchain, Ethereum is a crucial component of blockchain infrastructure, supporting various technologies including Rollup Layer 2 networks and account abstraction. Despite Ethereum's current dominance in Total Value Locked (TVL) and user base, it, along with its associated Layer 2 solutions, still faces challenges like insufficient throughput and transaction costs unsuitable for small, frequent trades. Therefore, Ethereum has continually enhanced its performance through upgrades and forks. In mid-2022, Ethereum achieved its first expansion milestone with 'The Merge', transitioning from Proof of Work (PoW) to Proof of Stake (PoS) consensus, importantly, marking the shift towards a Rollup-centric expansion path.

In 2023, Ethereum underwent a significant execution layer upgrade with the Shanghai upgrade, primarily allowing stakers to withdraw their staked ETH and rewards. Contrary to popular predictions that Ethereum's price might suffer due to the large amount of staking withdrawal, the network exhibited robust growth post-upgrade, maintaining stable operations with staking amounts rebounding after a slight drop – a sign of returning confidence among validators.

Ethereum's next significant milestone is the anticipated 'Cancun Upgrade' in Q1 2024, which marks a step towards its next major goal: sharding. A key proposal, Pro-Danksharding (EIP-4844), introduces Blob data blocks, offering cheaper data availability for Rollup and Layer 1 interactions, thus reducing Layer 2 transaction costs.

In the latter half of the year, Vitalik, co-founder of Ethereum, also raised the topic of "Exit games for EVM validiums: the return of Plasma," calling for a reevaluation of this overlooked expansion technology. While this sparked lively community discussions, Rollup expansion remains Ethereum's mainstream trajectory. In the future, we might see an Ethereum world where Layer 2s primarily execute, with Ethereum's main chain serving more as a consensus layer and data availability layer, providing foundational support for numerous Layer 2 networks.

2. Layer 2 Summer:

Layer 2 was a rapidly developing and highly watched sector in 2023. As of now, there are 32 active Layer 2 networks on the market, with Optimistic Rollup and ZK Rollup being the main types, according to L2Beat data. In terms of TVL, Layer 2's overall volume grew nearly threefold in 2023. From a TVL distribution perspective, Arbitrum One and OP Mainnet, both using Optimistic Rollup solutions, occupy the majority of the market share, with Arbitrum ONE accounting for 52% and Op Mainnet for 26.5%. The reasons include Arbitrum's early achievement of EVM compatibility, enabling seamless deployment of Ethereum and other Layer 1 projects. Additionally, the early coin issuance by Arbitrum and OP spurred significant ecosystem growth. In March, following Arbitrum's token airdrop, its ecosystem TVL saw a near twofold increase. However, ZK Rollup public chains lagged in terms of coin issuance and EVM compatibility, leading to slower ecosystem growth compared to Optimistic Rollup Layer 2s.

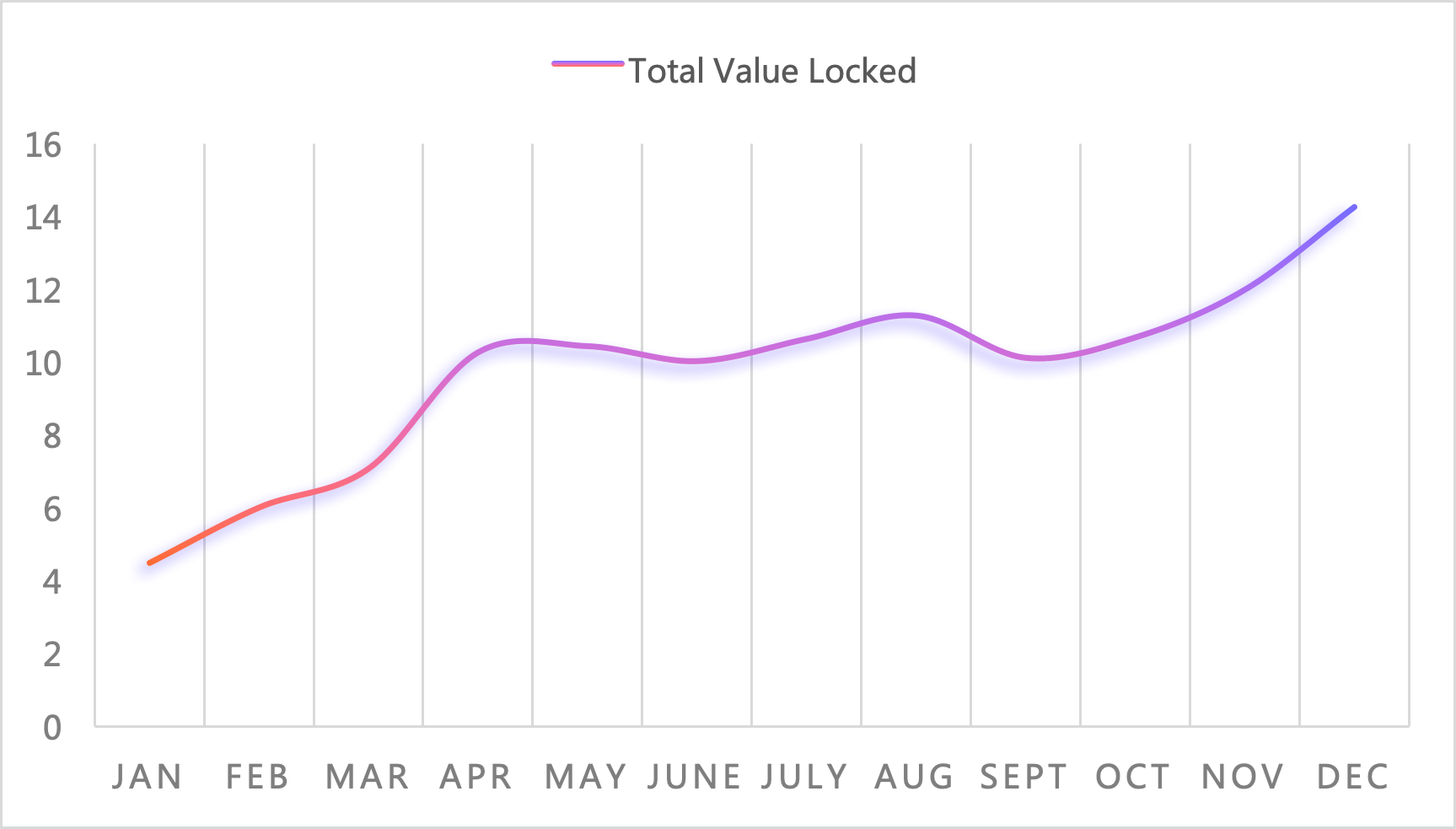

Image 1: Layer 2 Value Locked

In the flourishing year of Layer 2 networks, we also observed some issues. A primary concern is whether the data growth truly reflects network prosperity or a mere illusion. Many projects incentivize user interaction with the network through airdrop expectations, leading to more projects focusing on designing rules against Sybil attacks and attracting high-standard users. However, we believe that airdrops and token incentives, while effective during their application, quickly lose effect if the project fails to genuinely earn user trust on the product level. Additionally, current Web3 users are far from the general user standard, as mainstream users are relatively passive and less willing to shift between ecosystems. In contrast, current users willing to interact on Layer 2 networks tend to have some knowledge and operational skills. Therefore, this leads to increased customer acquisition and retention costs for the ecosystems, or what can be called ‘involution'. User loyalty to a public chain can easily diminish due to competitors' airdrop expectations and liquidity mining incentives. A prime example is the Blast network, launched in Q4 by Paradigm and Blur founder Pacman, as a Layer 2 network integrating native yield concepts. Blast extended Layer 2’s popularity to year-end, achieving a TVL of $300 million within just a few weeks of its launch. As a project backed by star developers and institutions, Blast distinguished itself in the competitive landscape by focusing on community-driven approaches, maximizing Product-Market Fit with simple yet effective features. This strategic move caught the market’s attention and capital, offering a unique contrast to other Layer 2s still vying for technical superiority and user quality.

Overall, we remain optimistic about the future development of Layer 2. With the further completion of EIP-4844 enhancing Layer 2 performance, we anticipate seeing innovative products in DeFi and other non-financial Dapps on Layer 2 in 2024.

3. Modular Blockchain Breaks Through Bottlenecks

While most public blockchains continue to evolve towards faster, cheaper solutions in pursuit of becoming the “mainstream” blockchain, a different solution often mentioned in 2023 is modular blockchain. Strictly speaking, rollups are also a form of modular technology, focusing on the blockchain's execution layer. This year, we observed increased attention towards the Data Availability (DA) layer in modular blockchains, such as Mantle and Celestia. Mantle, as a modular Rollup, uses its built-in data availability layer to free Layer 2 from Ethereum's data availability constraints. Celestia, on the other hand, is building a universal modular blockchain, allowing blockchains built on Celestia to use it as their data availability layer. We believe modular technology brings greater freedom; applications or Layer 2s are not bound by the main chain's performance and can gain greater autonomy and customizability. Although practical use cases for modular blockchains like Celestia are still few, we see promising growth in this direction.

However, we cannot ignore the complexities and security challenges accompanying the advancement of modular technology. This complexity is not only from a user perspective, as understanding a single blockchain's performance is relatively easy compared to comprehending the interactions with other modular layers. For developers, the interaction between multiple chains in modular blockchains exposes more security risks.

4. The Current State of Application Chains:

After the previous DeFi Summer, application chains emerged as a new approach to address network congestion and lack of autonomy. A pioneering example is the decentralized perpetual contract dYdX, initially deployed on Starkware. In October this year, we witnessed the mainnet launch of dYdX V4, marking its transition from an application to an application chain. Architecturally, dYdX chose Cosmos SDK, a popular application chain framework that allows application chains to customize consensus mechanisms based on real needs and interact with other chains in the Cosmos network through the IBC protocol. Currently, over 70 application chains have been deployed on the mainnet on Cosmos, becoming a mainstream implementation solution for application chains.

The primary advantages of applications developing their own chains include:

Performance Improvement: Application chains on the Cosmos network can leverage Cosmos' 10,000 TPS speed advantage. As they do not compete for block space with other applications, the environmental impact on the application itself is minimized.

Cost Reduction: In terms of transaction costs, application chains have significant advantages. For example, dYdX V4 redesigned gas fees, allowing users to pay fees proportional to their transaction volume instead of a fixed gas fee, offering an experience akin to centralized exchanges.

Increased Autonomy: Application chains can tailor solutions in various aspects, such as smart contract upgrades, data availability, and sequencer settings, according to the application's needs.

However, the transition to application chains also poses challenges, such as:

Liquidity Isolation: Independent application chains increase the difficulty for external protocols to interact with them. On Ethereum or other monolithic blockchains, the cost and barriers to interaction between applications are low. In contrast, application chains, being separate from other ecosystems, make cross-chain interactions the only way to engage with other ecosystems.

Security: The consensus security of smart contract applications is directly influenced by the security of the blockchain they are deployed on. The so-called security essentially depends on the public chain's market value. For application chains, their own market value determines their ability to sustain the assets on their protocols. This can be unfriendly for projects with smaller market values.

Therefore, we believe that application chains are not suitable for all applications. For example, projects that frequently interact with other contracts and have smaller market values are better off staying on a secure, thriving public chain. On the other hand, for projects requiring fast, low-cost transaction experiences, unsatisfied with the constraints of the public chain, and having a substantial user base, application chains can be an optimal way to maximize their protocol's value.

5. Account Abstraction Opens the Door to Hundreds of Millions of Web 3.0 Users:

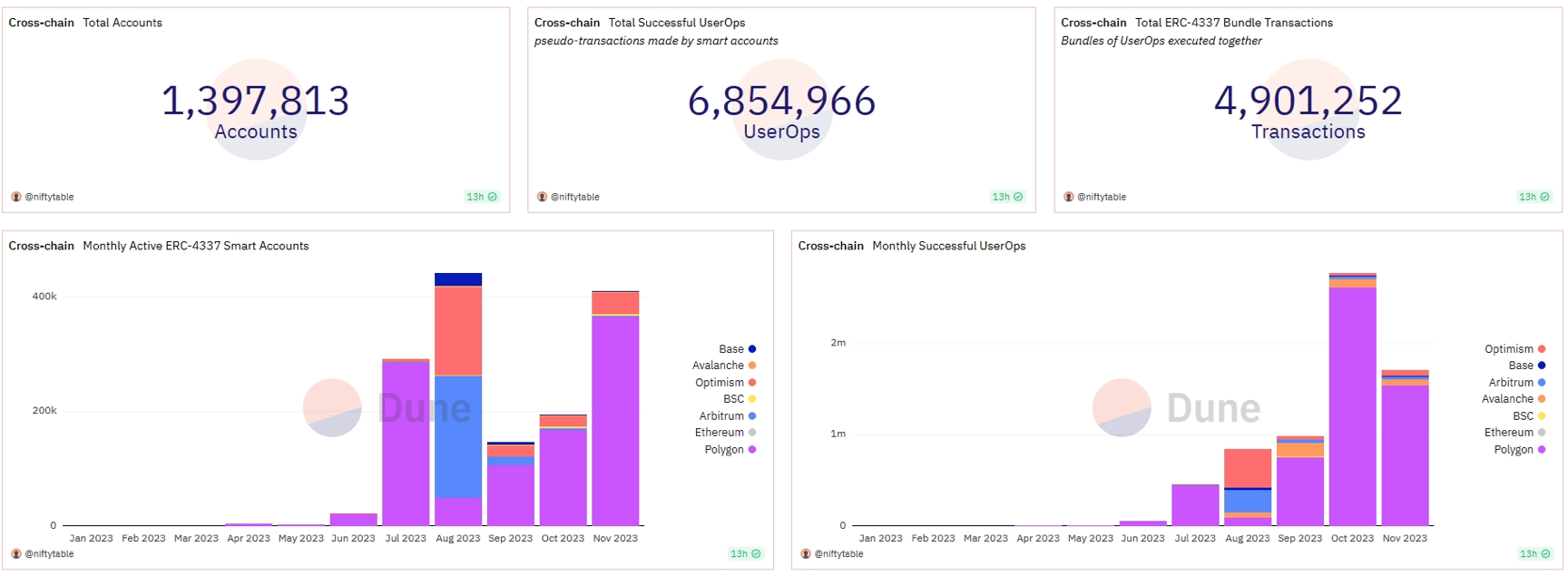

The concept of account abstraction first emerged in 2022, and with the update of EIP-4337 - an account abstraction proposal which completely avoids consensus-layer protocol changes, instead relying on higher-layer infrastructure - numerous teams began developing products around it. In terms of end-user products, the focus has mainly been on smart contract wallets integrating account abstraction, offering features like social login, social recovery, gas fee delegation, and batch transaction processing. Many teams have delivered products in this space in 2023, such as Argent, Avocado, and Unipass, each innovating significantly in user experience. According to Dune Analytics, there are nearly 1.4 million accounts created based on EIP-4337, generating close to 7 million transactions (UserOps). As of the time of this article, there are over 400,000 active smart contract accounts monthly.

Image 2: Adoption of ERC-4337 Smart Accounts

Source: Dune.com

Looking forward, we believe account abstraction has the potential to unlock the door to mass Web3 adoption. However, it still faces challenges, including increased security risks due to more complex technology stacks and rising gas fees. Therefore, we see Layer 2s, with their lower fee structures, as the ideal platform for developing account abstraction technology.

DeFi

Compared to the multiple significant incidents in 2022, the year 2023 was a period of stable development for DeFi (Decentralized Finance). In terms of protocol variety, there are now over 30 types of DeFi protocols, indicating a market that is more segmented and specialized than last year. Narratives around LSD (Liquid Staking Derivatives) and RWA (Real-World Assets) have brought new users and attention to DeFi. Below, we highlight some of the DeFi topics we believe are worth noting from 2023.

Three Noteworthy DeFi Trends in 2023:

1. Current State of DeFi Protocols:

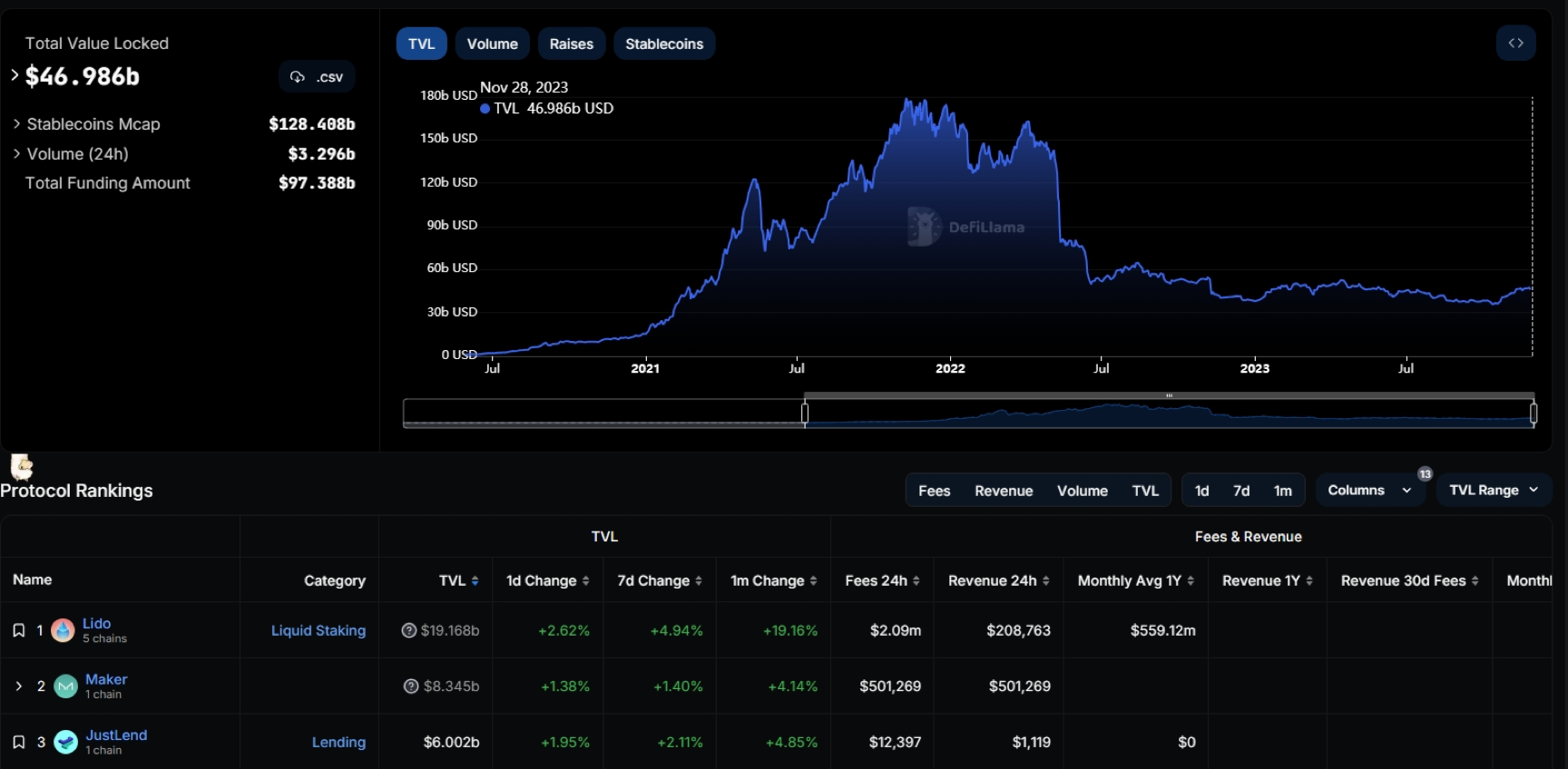

In 2023, DeFi maintained a stable Total Value Locked , with $47 billion locked in DeFi contracts as of the time of writing, a 23.6% increase from $38 billion on December 31, 2022.

Image 3: Total Value Locked

Source: Defillama.com

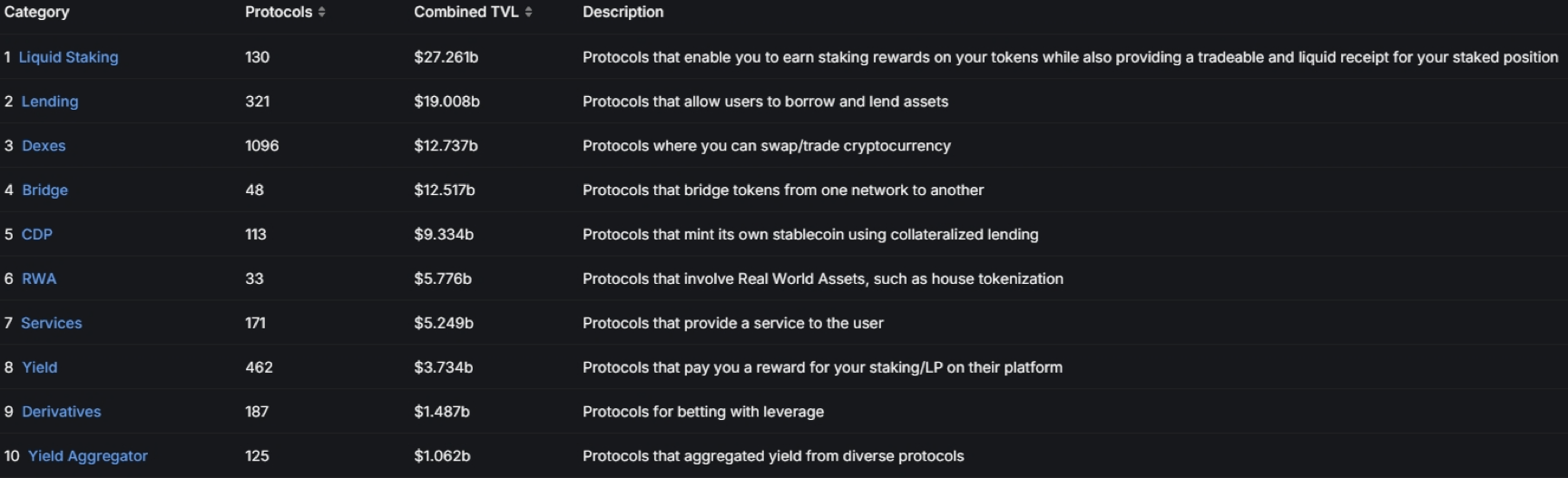

In terms of public chain dominance, Ethereum holds a 56% share, maintaining a clear lead, followed by Tron with a 16% share. Among projects, Lido, Maker, and Justlend rank in the top three in TVL, with Lido alone accounting for 41% of the entire chain's TVL.

Revenue-wise, Maker leads with daily earnings of $500,000. Among the top twenty revenue-generating projects, eight are exchanges or derivatives exchanges, and three are lending protocols. Exchange and lending remain the top protocol types for generating value in DeFi, albeit in a highly competitive environment. Currently, there are over 1000+ decentralized exchange protocols spread across 234 public chains.

Image 4: DeFi Category

Source: Defillama.com

2. Real-World Assets (RWA):

RWA is a new DeFi theme that cannot be overlooked in 2023. It has drawn significant attention in a relatively subdued market. Typically, RWAs focus on off-chain rights confirmation and transferring off-chain assets and their associated returns to the blockchain. Legal tender stablecoins, as a form of RWA, have already demonstrated their critical use case in the cryptocurrency market. Other real-world assets linked to RWA saw a surge in 2023, with MakerDAO’s U.S. Treasury Bonds RWA reaching a scale of $2.8 billion, marking the first step towards large-scale RWA application. Avalanche has also developed its RWA ecosystem, aiming to provide a suitable on-chain platform for traditional institutional capital.

The macro background here is the Federal Reserve's interest rate hike, which led to U.S. Treasury yields rising to 5%. In 2023, when overall DeFi market returns were low, transferring real-world returns to the blockchain was a natural progression. However, future advancement in RWAs will require extensive off-chain infrastructure, improved regulation, and advancements in on-chain oracles, wallets, and cross-chain technology. Nevertheless, the door to on-chain real assets has been opened, and we anticipate seeing more potential in RWA assets in 2024.

3. Decentralized Stablecoins:

For mainstream stablecoins like USDT and USDC, there has always been criticism about their centralized risks. Currently, USDT and USDC command over 90% of the market share. The depegging incident of USDC in March heightened discussions about the risks of centralized stablecoins. The crypto market has continually experimented with creating a crypto-native stablecoin as detached as possible from traditional world risks. As of November 29th, there are over 120 stablecoins issued through over-collateralization (CDP), and we've seen a trend in 2023 where major DeFi protocols are developing their native decentralized stablecoins. Examples include Curve's crvUSD and AAVE's GHO, with crvUSD reaching a circulation of 140 million and AAVE minting 3.48 million GHO on Ethereum. Although there are many challenges yet to be resolved in the development of decentralized stablecoins, such as GHO's price not consistently pegging to $1 since its launch, we expect to see more native crypto stablecoins in the future, reducing reliance on USDT and USDC.

Bitcoin

As we approach the end of 2023, Bitcoin has regained robust momentum, notably breaking the $40K barrier for the first time in a year since October. Market has shown a significantly bullish indicator over Bitcoin and its related assets. However, questions arise: Will this trend sustain into the coming year, or is it merely a short-term hype driven by expectations of ETF approval? Today we will delve into the underlying fundamental drivers and discuss our view towards the future outlook on the bitcoin ecosystem.

Key Catalysts Fueling Bitcoin's Growth:

Favorable Macro Environment

Bitcoin has shown an outperformance trend in late 2023 compared to traditional TMT equities. With that being said, the market has already priced in the factors of interest rate decline in the upcoming months, while the investors expect that economic recovery may take a longer period of time to be reflected on the corporate balance sheet. Meanwhile, investors have been on an active outlook to hedge against the unstable geo-political and economical crisis upon 2023. Granted by the inherent store-of-value attributes, Bitcoin evolves as “digital gold” and has been considered to be a new type of alternative assets for investors.

Here's the BTC price

Anticipated Money Inflow from Institutions

One of the key market sentiment drivers among Bitcoin trading is the active Spot ETF application from various traditional Asset Managers. This indicates the embracement and recognition of investment values on Bitcoins from the traditional markets. On another hand, approval on spot ETFs is anticipated to bring in new money inflow and liquidity from the institutional markets, with the participation from Authorized Participants and Market Makers, pushing further trading activities and capital efficiency on Bitcoin markets.

Aside from this, traditional financial institutions have also spearheaded efforts on Web3 adoption by setting up web3 strategy and investment arms. For example, Standard Chartered Bank, Nomura (Laser Digital), UOB, JP Morgan, etc. This has further strengthened the bullish sentiment and potential new money inflow from traditional finance on Bitcoin or even the broader crypto ecosystem.

Bitcoin Halving

Bitcoin’s next halving will take place in Q2 2024. Halving events occur every four years, where the block reward for Bitcoin mining is shrinked half. This process will significantly reduce the inflation rate of Bitcoin. Based on historical trajectory, the market in general anticipates that Bitcoin prices will reach All-Time-High upon half year post-halving. Further fueled by the capital inflow anticipation from traditional institutions, the demand has largely outstripped supply for Bitcoin market, pushing further surge on Bitcoin prices.

Innovations from Bitcoin Ecosystem

The POW blockchain of Bitcoin was designed mainly for transfer of value initially with lack of composability. The recent breakthrough on technical architecture brought by taproot, ordinals and other emerging standards have brought in further composability, programmability and transaction efficiency on Bitcoin. These further unlock the potential on Bitcoin for trustless staking, complex Defi strategies, or even gaming. Bitcoin as a bluechip cryptocurrency with an existing huge penetration rate, under such technical advancement, is anticipated to achieve further adoption in the near future.

With these factors in play, we maintain a bullish stance on Bitcoin's growth in the upcoming year. Active product development initiatives observed over the past year indicate several key areas to watch within the Bitcoin ecosystem:

Developer SDKs and Marketplaces: Oyl, Unisat

ZK Rollups: Bison, Chainway, Alpen Labs

EVM L2s/ Scaling Solutions: Botanix Labs, B2 Networks, Bitcoin Wizard

Side Chains: Liquid Network, Threshold Network

Staking: Babylon

In conclusion, these developments and initiatives suggest a vibrant and evolving landscape for Bitcoin, positioning it for continued growth and innovation in the foreseeable future.

SocialFi

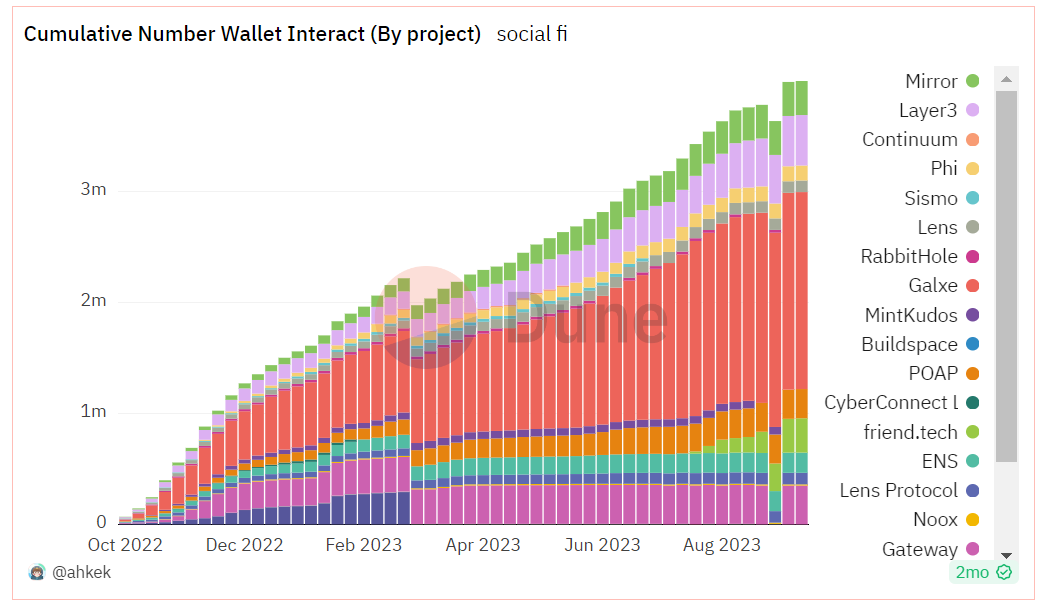

Since 2021, the SocialFi track has gradually entered the crypto community's radar. Similar to the social and entertainment attributes of blockchain games, it is considered a phenomenon-level track capable of attracting a significant influx of new Web3 users. Compared to the relatively lukewarm situation of the entire track in 2021-2022, some innovations in gameplay and design in the SocialFi track gained notable traction in 2023. As shown in the following figure, the entire SocialFi track has experienced favorable development over the past year, with mainstream projects accumulating nearly 4 million+ wallet interactions, and new projects like Galxe, Friend.Tech, and Sismo gaining substantial traffic.

Image 5: Cumulative Number Wallet Interact Graph By Project

Source: dune.com

From the perspective of specific blockchains, current major SocialFi project interactions are concentrated on Polygon and Base chains, with other chains receiving less traffic in the social domain. In addition to providing stable networks, fast processing speeds, and low interaction costs, Polygon has actively developed various gaming, NFT, and application projects within its ecosystem over the past 1-2 years. Collaborating with Web2's major IPs has garnered significant traffic from both within and outside the crypto domain, showing a consistent and stable traffic growth in the SocialFi track. Base, benefiting from the substantial traffic brought by Friend.Tech, currently occupies half of the SocialFi track's traffic. Other chains, like Ethereum and BNB, are experiencing comparatively slower community-related traffic growth.

Image 6: Cumulative Number Wallet Interact Graph By Chain

Source: dune.com

Currently, SocialFi track projects are mainly divided into three mainstream development directions:

Social Infrastructure:

Social infrastructure forms the foundational building blocks and universal tools for the entire SocialFi track. Unified, simple, and convenient infrastructure helps lower user barriers, reducing usage hurdles between different Dapps while accumulating more users and data. Projects like Galxe, Lens, and CyberConnect have entered from various dimensions, connecting users and Dapps, becoming the traffic portals and interfaces for the Web3 SocialFi track. This track is expected to experience phased traffic growth opportunities with the further maturity and explosion of ecosystem projects.

Social Dapps:

Social Dapps represent the largest project category within the SocialFi ecosystem, showing a vibrant development trend. These include forums, fan platforms, streaming media, social games, social identity, etc. Dapps are the most direct point of contact and binding with users. In 2023, some projects achieved good development results, with Friend.Tech's ecosystem being particularly prominent due to its clever economic design and capital amplification factors, providing a valuable reference for subsequent social project development and design. The main development direction of Social Dapps is focused on decentralized resistance to censorship and engaging gameplay for traffic growth, satisfying the needs for social privacy and social gaming attributes. This track currently hosts a plethora of project developers and active players, nurturing potential Alpha projects for the next bull market in the SocialFi track. Other projects like Facaster, Nostr, and RepubliK also have considerable discussion in the market. Generally, most Social Dapps are in the mid-development stage, either operational or in test runs, with potential project launches or token issuances following the launch of infrastructure projects.

Social Bots:

Social bots have been another type of project attracting market traffic in the SocialFi track in 2023, primarily built on Telegram. These include trading bots, farming bots, and Q&A bots, with representative projects like Unibot, Banana Bot, Wagie Bot, and LootBot. These projects are mainly created on Telegram, a social network platform with 800 million monthly active users, implementing encrypted transaction applications. Strictly speaking, social bots are Web3 projects derived from Web2 social interactions, whose convenience greatly lowers the entry barrier for users, effectively utilizing platform advantages to expand a significant number of new crypto users. These Web2-friendly projects have broad market demand and development prospects. Similar to games and Social Dapps, social bots are also one of the incremental tracks for the next bull market.

In summary, the Web3 SocialFi track is in the early-to-mid stages of development, relying on the maturity of other infrastructure constructions, including but not limited to cross-chain information transmission, data storage, transaction cost reduction, and compliance issues. Current SocialFi track project types mainly include social infrastructure, Social Dapps, social bots, and other social tools. Among them, Social Dapps have the most diverse categories and are most likely to nurture Alpha products for the next bull market. A large number of developers are currently developing Web3 social products, and capital is gradually paying attention to and investing in this track. With the launch and token issuance of some popular projects, the market heat of the SocialFi track is gradually climbing. While the SocialFi track presents opportunities, it's also important to be aware of the challenges it faces, including the need for more robust infrastructure, bottlenecks in new user growth, and potential regulatory issues. Overall, the crypto social track is expected to see a concentration of project maturity, launches, and token issuances in 2024, holding promising investment potential and growth prospects.

GameFi

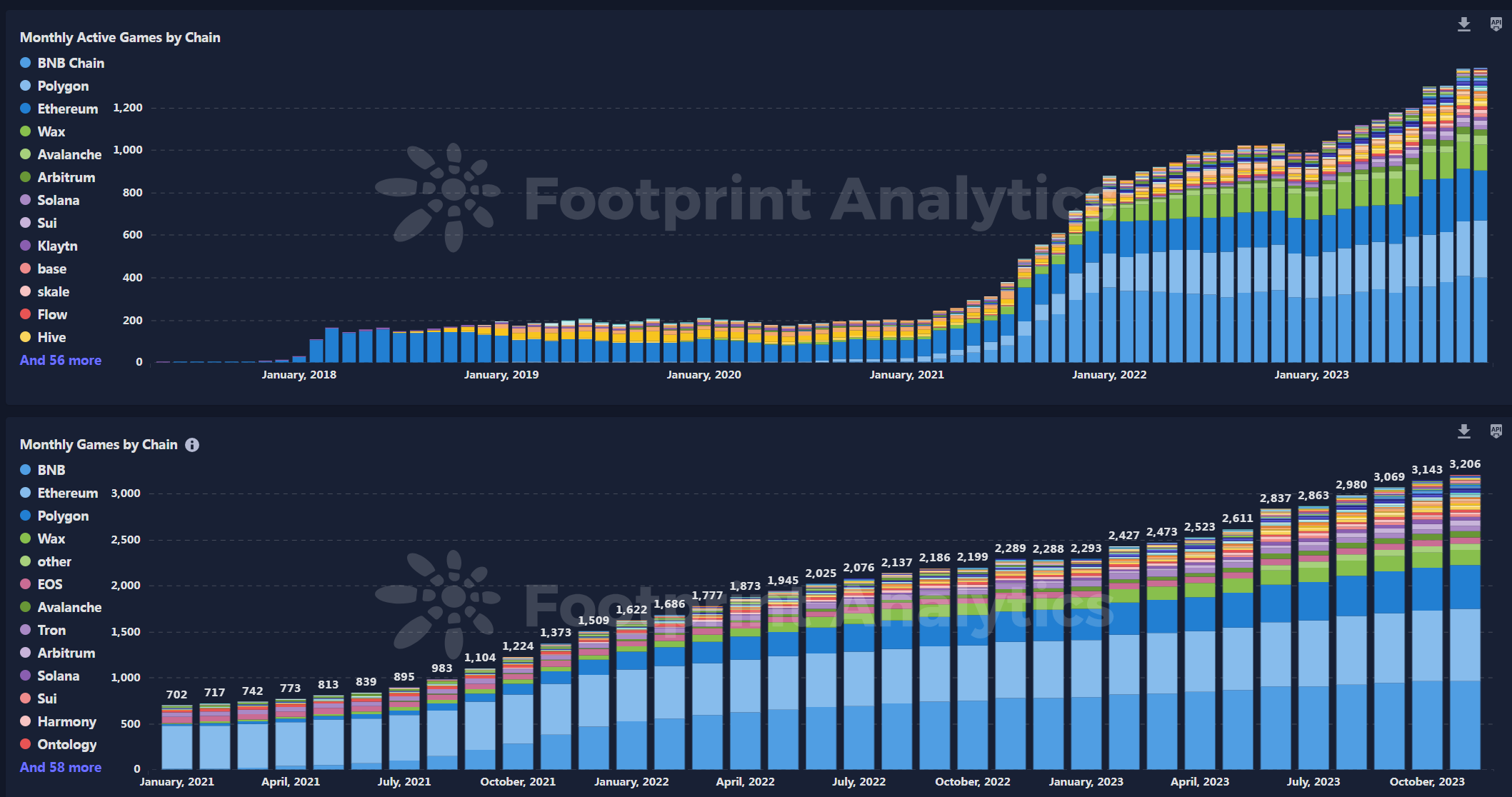

The gaming sector in 2021 witnessed a significant influx of traffic and capital, followed by a cooling off in 2022. The reduction in the 'wealth effect' led to a steep decline in games reliant on 'play-to-earn' models for user growth. In 2023, the gaming sector exhibited a more stable performance. Originating in the bull market as a traffic-driven sector, already-tokenized blockchain games went through prolonged consolidation during the bear market. Many projects financed towards the end of the bull market have nearly completed their development, suggesting a continued positive impact on traffic and project performance in this cycle.

As per data shown below, gaming projects continued to show a steady growth trend in 2023. According to Footprint Analytics (data as of December 1, 2023), there are over 2,600 blockchain game contracts in the current market, with a circulating market value exceeding $6.5 billion, daily transaction volumes surpassing $6 million, and daily active addresses exceeding 1 million. Despite the bear market, the sector maintained a certain level of activity.

Image 7: Game protocol growth in terms of numbers and growth rate

Source:footprint.network

From an ecosystem perspective, daily active addresses in the market exceed one million, with the bulk of absolute traffic concentrated on the Wax chain. Benefiting from its low interaction costs and swift settlement experience, Wax has maintained its leading market share through both bull and bear markets. Other public chains like Near, Celo, and Polygon also hold significant market shares.

1a

Image 8: Daily Transactions & Active Users & Volume by Chain

Source:footprint.network

In terms of HTX GameFi project development, overall, the growth in gaming projects in 2023 exceeded that of 2022, thanks to the development and maturation of startups from the last bull market. The BNB chain continues to host the most gaming projects, followed closely by Polygon, Ethereum, and Wax, each holding a significant share in game ecosystem deployments.

Image 9: Monthly Active Games by Chain

Source:footprint.network

The blockchain gaming ecosystem in 2023 demonstrated steady development, and this track is expected to perform well in the next bull market. Unlike the previous bull market, driven by tokenomics, the next cycle may shift focus from play-to-earn to entertainment value, with the long-term entertainment attributes of games being re-evaluated. As one of the most anticipated user traffic tracks in Web3, the next bull market is expected to break new ground in user accessibility, facilitating a seamless transition for Web2 users to blockchain games. Additionally, in terms of game types, alongside traditional blockchain games, the development of high-quality 3A games and full-chain games has become a key focus during this bear market. 3A games, with their high production values and playability, are poised to attract a phenomenal increase in users. Meanwhile, exploration in full-chain games is expected to bring about new types of asset interactions and gameplay upgrades, enriching game design and experiences.

Summary Outlook for 2024

As we advance into 2024, HTX Ventures stands at the forefront of a transformative phase in the blockchain and cryptocurrency sectors, buoyed by optimism and a clear vision. Key trends and developments that are poised to shape the crypto landscape in the coming year include:

- Trading Innovation: The rise of sophisticated trading bots and novel trading infrastructures is a testament to the ongoing innovation in trading mechanisms, hinting at more dynamic and efficient market interactions.

- Layer 2 Evolution: With the eagerly anticipated Cancun upgrade, the intensifying competition among Layer 2 solutions will likely catalyze significant advancements in scalability and efficiency, further solidifying this sector's critical role.

- Web3 and X-Fi Dynamics: A notable shift toward authentic Web3 projects, such as the success of platforms like Friend.tech, signals an evolution towards a more integrated approach, blending social and gaming elements within the crypto realm.

- Convergence with Traditional Finance: The discourse around Bitcoin ETFs and Real-World Assets (RWAs), particularly with the potential for a Bitcoin spot ETF breakthrough, underscores a growing convergence between traditional finance and the crypto industry, potentially marking a new era of market growth and mainstream acceptance.

In 2024, HTX Ventures remains committed to navigating these developments, leveraging our expertise and insights to support and enhance projects that are not only at the forefront of technological innovation but also strategically positioned for long-term impact and success. Our optimism for the coming year is rooted in the potential of these trends to catalyze meaningful advancements and create new opportunities in the ever-evolving crypto landscape.

About HTX Ventures:

HTX Ventures, the global investment division of HTX, integrates investment, incubation, and research to identify the best and brightest teams worldwide.

With a decade-long history as an industry pioneer, HTX Ventures excels at identifying cutting-edge technologies and emerging business models within the sector. To foster growth within the blockchain ecosystem, we provide comprehensive support to projects, including financing, resources, and strategic advice.

HTX Ventures presently backs over 200 projects spanning multiple blockchain sectors, with select high-quality initiatives already trading on the HTX exchange. Furthermore, as one of the most vigorous Fund of Funds (FOF) investors, HTX Ventures collaboratively forges the blockchain ecosystem alongside premier global blockchain funds, including IVC, Shima, and Animoca.

Written by: Haiyi, Juliet, Gigi, Jenny

Reference:

https://www.eip4844.com/

https://www.erc4337.io/

https://vitalik.ca/general/2023/11/14/neoplasma.html

https://dune.com/niftytable/account-abstraction

https://defillama.com/

https://defillama.com/stablecoins

https://gho.xyz/

https://crvusd.curve.fi/

https://www.demandsage.com/telegram-statistics/#:~:text=How%20Many%20People%20Use%20Telegram,800%20million%20monthly%20active%20users.

https://www.footprint.network/research/gamefi/game-overview/chain-stats?series_date-79658=past90days~

PreviousNextMore Tutorials

Share to

Language